do you have to pay taxes when you sell a used car

In NSW the duty is calculated at three percent of the cars market value up to 45000 and five percent for any. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

Business Use Of Vehicles Turbotax Tax Tips Videos

Yes used cars do have a sales tax and so you will have to pay a sales tax when you buy a used car.

:max_bytes(150000):strip_icc()/GettyImages-160143914-490a0fd99380456fb809d575104c4719.jpg)

. Is sale of motor car taxable. You pay sales tax on a used car regardless of whether you buy a vehicle from a dealership or an individual. You typically pay capital gains tax CGT on the profits you make on investments.

Answered by Edmund King AA President. In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. When you sell a car for more than it is worth you do have to pay taxes.

For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit. In California the sales tax is 825 percent. However you wont need to pay the tax.

How much tax do you pay when you buy a car privately. That is assuming that you live in a State which implements sales tax. You dont have to pay any taxes when you sell a private car.

Even in the unlikely event that you sell your private car for more than you paid for it special. Is selling a car taxable income UK. Everyone has an annual tax-free CGT allowance of.

In this case youll owe capital gains tax on the profit you make when the vehicle is sold. You dont have to pay any taxes when you sell a private car. This is because you did not actually generate any income from the sale of the vehicle.

You likely paid a considerable amount of money for your car. You dont have to pay any taxes when you sell a private car. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and.

A taxable gain occurs when something sells for more than its cost basis. Tax on Sale of Motor Vehicle If used for Business then motor vehicle is considered as capital asset and chargeable to tax as Long term capital gain or short term. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and.

Selling a car for more than you have invested in it is considered a capital gain. Thus you have to pay. So if you live in a state with a.

If youre selling a car for less than you paid for it you will not have to pay taxes on it. To calculate a capital gain on a used car find its original price and subtract the sales tax. Its very unusual for a used car sale to be a taxable event.

Most car sales involve a vehicle that you bought new and are.

Car Financing Are Taxes And Fees Included Autotrader

/cloudfront-us-east-1.images.arcpublishing.com/tgam/TH7YQHO7VRFELJ5RZCK74AWFCY.jpg)

Why Should I Have To Pay Taxes On A Used Car The Globe And Mail

Thinking About Buying A Car Here S What Experts Say You Need To Know

Capital Gains Tax What Is It When Do You Pay It

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

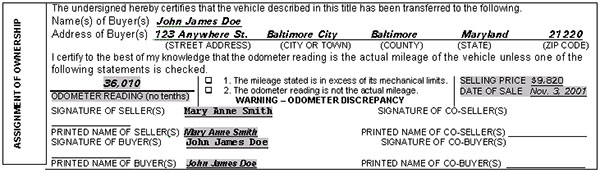

Buying A Car Without A Title What You Should Know Experian

Do You Pay Sales Tax On A Car Down Payment Green Light Auto Credit

Sell My Car Sell Or Trade Your Car Online Autonation

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Car Tax By State Usa Manual Car Sales Tax Calculator

Sell Your Car In Cincinnati Oh Subaru Of Kings Automall

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

Buying A Vehicle In Maryland Pages

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

How To Sell A Car With Financing Get Cash For Cars Near You

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Do Tax Deductions Work When Donating A Car Turbotax Tax Tips Videos

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds